Income Generating Assets

I read newspapers every day and stories of government workers striking for a pay-raise are ever-increasing in Uganda. Today, it’s the teachers, tomorrow it’s the lecturers in universities and the other day it’s the magistrates and doctors. That’s the trend nowadays and I pity the employer: the government. Because of that, I appeal to my readers working for others to think investing in income-generating assets as a way to achieve financial freedom.

One day, I attended a seminar when I was still employed. I don’t still remember what it was about. But at the end of that seminar, the organizers brought a motivational speaker who talked about investing in income-generating assets. He is one person that changed my life, a man I will never forget to talk about and to use as a reference. This gentleman told us that as we are working, we should consider it so important to acquire income-generating assets. He explained to us that an asset is something you have that you can use to make money. A liability is something you have but which takes away your money. Reflect on the things you have! Are they assets or liabilities?

For instance, a car is an asset if you use it to make money. But it’s a liability if you have it just for the sake of having it because it takes away your money in fuel and maintenance without giving you any income. Surprisingly, most salary earners in Uganda invest their money in liabilities such as cars, houses, girls, bars and the like. They, therefore, have a big expenditure column and a small asset column. They depend entirely on their salaries to have a living. This is a dangerous situation that keeps them wanting for more salary increases all the time.

But the truth is that you cannot work for money and achieve financial freedom. Financial freedom is for people who think about making money as opposed to working for money. Going back to the government workers who are ever on strike for a pay raise, the truth is that even if the government increases their salaries a hundred times, they will continue to strike. Why? Because most people in formal employment unknowingly spend on liabilities instead of investing in income-generating assets when they get their monthly salaries.

This is therefore my humble appeal to whoever is formally employed. Today, you have a job. Tomorrow, you will not have it. What matters is not how much you earn monthly, but how you use your income from your salary to build a strong asset column. This is when you can be destined for financial freedom. I have told you the motivational speaker changed my way of looking at things. From that seminar, I scratched my head trying to look for assets that I could use to make money.

Secondly, I developed a burning desire to pull out of formal employment and to become financially free because the salary I was earning was never enough. This is not to say that it was small. It was indeed comparatively big with many several benefits of a house, a car and other allowances. However, all those allowances and the salary were never enough to meet my personal needs.

Besides, I wasn’t enjoying the freedom of doing what I wanted and doing it for myself. In the same way, if you’re employed, you are not different from me at that time. And if your salary is small, better take on my ideas of investing the little money you earn in income-generating assets.

What Income-Generating Assets Can You Invest In?

This is a question for which I cannot have a conclusive answer. But what I know is that knowledge is an asset. Additionally, when you acquire something that you use to make money, you have an asset. You should probably think along those lines.

By way of example, let me use my own experience. When I realized that I had to invest in income-generating assets, what came to my mind was to invest in assets that could eventually enable me to start a business. My mind, therefore, revealed to me that through learning graphic designing skills, I could open my chances to make money if I also acquired the right tools. I, therefore, invested in CorelDraw graphic designing software (purchased at USD 499). After buying it, I started seriously teaching myself graphic designing. Nobody taught me. I taught myself with probably the help of some colleagues I befriended in the USA with an aim of learning.

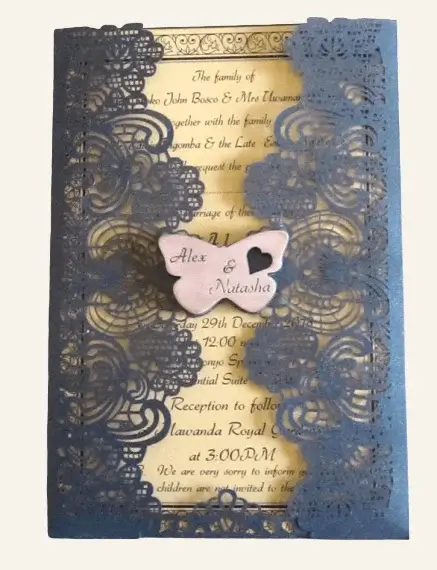

Secondly, I realized that I could make money with my graphic designing skills if I acquired the right tools. The tools you can use to make money with graphic designing are many but I picked interest in a laser engraving machine. Laser engravers are damn expensive. I couldn’t afford it at that time. But I had to save by all means to acquire one. It took me several years of saving until I finally acquired our first laser engraver. Thirdly, I noticed that I needed to invest in sustainable ways of marketing our business. As you know, marketing is the backbone of any business. Without it, no business can survive. But we needed to invest in affordable and sustainable marketing methods. We, therefore, learnt to design simple websites for business and internet marketing as well.

Income Generating Assets

Which Income-Generating Assets Did We Invest In?

To remind you, we invested in the following income-generating assets: #1 – CorelDraw Graphic Designing Software, worth USD 499 at that time. #2 – We spent time teaching ourselves graphic designing. That was a great investment, which we undertook when we were still in formal employment during our free time in the evening and weekends. #3 – Laser engraving machines and other related tools. We painfully saved to buy our first laser machine for not less than 7 years. #4 – Website designing This was after realizing that we needed to undertake modern sustainable marketing methods to grow our business. We, therefore, learnt web designing to design and develop the business website we eventually set up. #5 – Online marketing We spent money and time learning online marketing, which we currently use to market our business.

What Do We Mean by Investing in Income-Generating Assets?

It’s simple. Using our real experience, you can see that the income-generating assets we invested in included both tangible and intangible assets. They also included spending money to buy the physical assets, time to save and to learn the skills. That’s what we mean. Everyone has their specific field of interest and specialization. You, too, can think of investing in income-generating assets related to your specific field of interest, ability or potential.

Conclusion

Acquiring income-generating assets is so important and one of the steps to financial freedom. You achieve financial freedom when you have the freedom to be what you want and to do what you want in life. It’s when your assets can generate enough income that surpasses your expenditure. You, therefore, get a sense of relief and you make financial decisions without being feeling the impact because you’re prepared. Next time we shall share with you what else you need to do to achieve financial freedom. If you have any additional points to share with us, please leave your contribution in the comment section below.

0 Comments

Trackbacks/Pingbacks